Hey there, future millionaire!

Ever peeked into your bank account at the end of the month and wondered, “Where did all my money go?” You’re not alone. We live in an age of instant gratifications and swipe-happy transactions. But what if I told you, you could live your best life and have some savings to show for it? Intrigued? Let’s dive in!

Why is Putting Money Aside Important?

Stats Speak: A survey by the Federal Reserve found that about 40% of Americans would struggle to come up with $400 for an unexpected expense. This statistic underscores the importance of having a safety net.

Setting money aside isn’t just about avoiding debt or covering those unforeseen expenses. It’s about creating opportunities: that new course you want to take, the dream vacation, or even starting your own business.

Understanding the Psychology Behind Saving

Why do some folks save easily while others struggle? A Cambridge University study suggested that our financial habits form as early as age 7! But no worries if you weren’t a kiddo saver; habits can be reshaped at any age.

Tips for rewiring your brain:

- Visualization: Have a goal in mind, be it a vacation or a house. Visual reminders like pictures can be powerful motivators.

- Rewards: Set milestones and reward yourself (frugally) when you reach them. Positive reinforcement can work wonders.

But How Much Should I Save?

Ah, the million-dollar question! Financial gurus suggest saving 10 to 15% of your income. But let’s be real, everyone’s situation is unique. Start with what’s feasible. Even if it’s just 2% of your paycheck, it’s a start!

How Do I Actually Do It?

1. Pay Yourself First: Treat your savings as a non-negotiable expense. Before paying any bills, set aside a portion of your income. Over time, you won’t even notice it’s gone.

2. Automate, Automate, Automate: Out of sight, out of mind. Set up an automatic transfer from your checking to your savings account. No thinking, no forgetting, just saving.

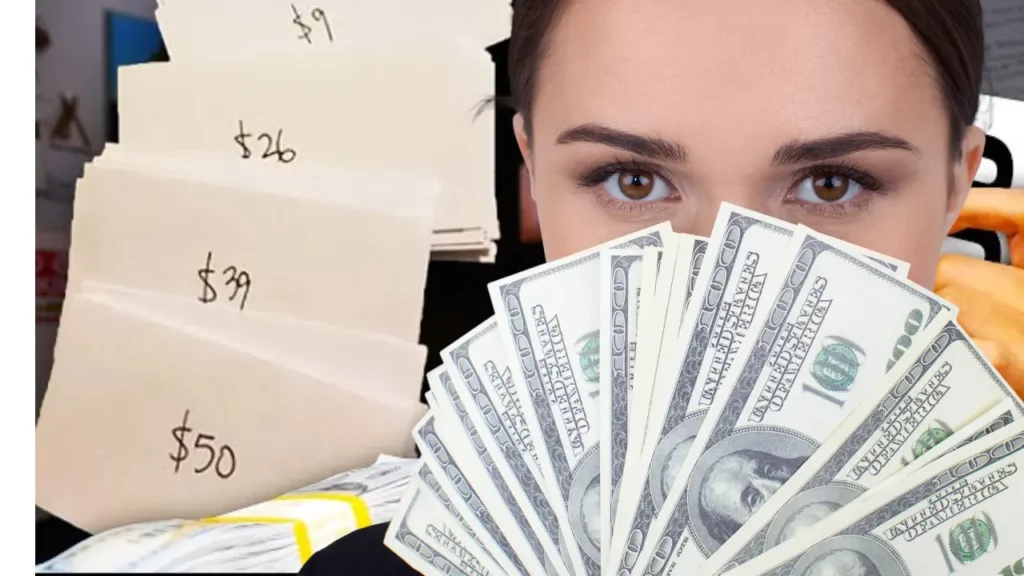

3. The Envelope System: Remember grandma’s old envelope trick? One envelope for groceries, one for rent, etc. It’s old-school, but it works. Allocate cash in envelopes for different expenses. Once it’s empty, that’s it until the next month.

How to use the envelope system:

- Collect envelopes and mark each one with specific expense categories like groceries, fuel, entertainment, and eating out.

- At the start of the month, take out cash from your bank and distribute it among the envelopes according to your planned budget.

- For any expenditure within a category, draw from its designated envelope.

- When an envelope is depleted, halt expenses in that area until the upcoming month.

Dive Deep: Saving Hacks & Creative Solutions

1. The 52-Week Challenge: Save $1 the first week, $2 the second, so on. By week 52, you’re setting aside $52. Total saved by year-end? A whopping $1,378

2. Purchase Delay: Want to buy something non-essential? Wait 30 days. If you still want it after a month, go for it. More often than not, the urge passes.

3. Unsubscribe: Those marketing emails from online stores? Unsubscribe. Out of sight, out of mind. Fewer temptations = more savings.

4. DIY: Whether it’s making your coffee, doing your nails, or cooking more at home—sometimes, the old ways save more pennies.

5. The Spare Change Jar: Every time you break a bill, pop the change into a jar. It might sound petty, but a study in 2018 showed that people saved an average of $70 a month using this trick. That’s $840 a year!

6. No-Spend Days: Designate one day a week where you don’t spend a penny. It’s a game-changer, trust me.

7. Round-Up Savings Apps: Apps like Acorns round up your purchases to the nearest dollar and invest the difference. Buy a coffee for $3.50? $0.50 gets saved. It adds up!

Investing: The Big Brother of Saving

Saving is great, but making your savings work for you is even better. The magic word? Investing.

Why it matters: The average savings account interest rate hovers around 0.06%. Compare that to the S&P 500’s average annual return of about 10%. The numbers speak for themselves!

Getting Started: Don’t be daunted by the world of stocks, bonds, and mutual funds. Start with robo-advisors or low-cost index funds. Remember, it’s about the long game.

In Conclusion: Let’s Get Saving!

Financial freedom isn’t just a buzzword; it’s attainable. Remember, every savings journey starts with a single step—or in this case, a single penny. Equip yourself with the right knowledge, the right tools, and a sprinkle of determination, and watch your savings grow.

By embracing smart saving hacks, celebrating your milestones (big or small), and learning continuously, you’re not just saving money—you’re investing in your future. So, what are you waiting for? Let’s make those savings dreams a reality! 💰✨