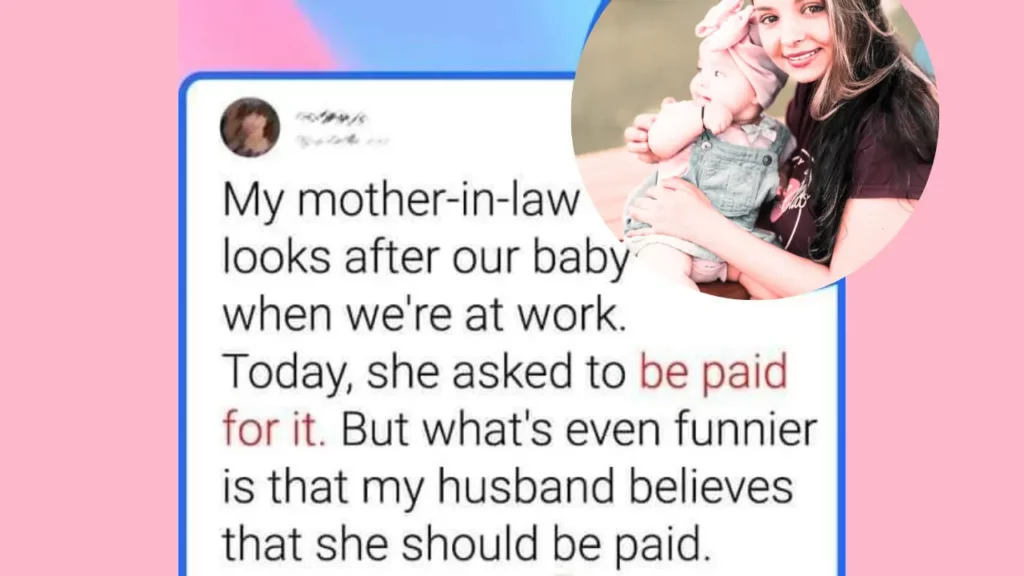

In a family drama that’s stirring up controversy, a local mother-in-law has thrown traditional family roles into chaos by asking to be paid for babysitting her grandchild. This bold move, defying conventional family norms, has sparked heated debates in the community.

Long seen as the dependable, unpaid caretaker, this mother-in-law’s demand for compensation is challenging the age-old expectation of grandparental generosity. Her son’s unwavering support of her claims adds fuel to the fire, leaving the daughter-in-law caught in a familial tug-of-war.

This isn’t just a local family quirk; it’s a snapshot of a broader societal shift, where traditional family values collide head-on with contemporary challenges. It’s a tale that resonates with many, as it questions the very foundation of family roles and responsibilities in today’s world.

Paying The Mother-in-Law vs. Family Values

From social media discussions, our community debates whether the mother-in-law should be paid for caring for her grandchild.

Supporters of the mother-in-law argue that her request reflects the economic challenges faced by many families today. They emphasize the exorbitant cost of childcare, which often compels parents, particularly mothers, to make difficult career choices. To them, compensating the grandmother is a just recognition of her vital role in supporting the family.

On the opposing side, critics express concerns about the potential shift away from cherished family values. They contend that family bonds should transcend monetary exchanges, emphasizing the significance of selfless caregiving within the family circle. Paying a family member, they argue, may commodify love and care, eroding the sanctity of familial relationships.

While supporters of payment argue that it is a fair recognition of her valuable contributions, opponents express concerns about the potential erosion of family values. At the heart of this debate lies the broader issue of child care costs in the United States.

The Cost of Child Care for American Families

The outrageous cost of child care in the United States has become a full-blown crisis for working families. This financial burden often forces parents to make difficult choices about their careers, and it also plays a significant role in the debate over paying the mother-in-law for babysitting.

Average expenses for child care in the U.S.

In the United States, the outrageous cost of child care is not just an expense; it’s a full-blown crisis for working families. Imagine this: parents with infants are shelling out an eye-watering $1,300 every month. That’s almost $16,000 a year just to ensure their little ones are in safe hands while they work. This financial nightmare eats up a staggering 15% of the median household income, spotlighting the brutal economic battle families face just to afford decent child care.

Impact of childcare costs on working families

But here’s the real kicker: these astronomical costs are pushing working families, especially mothers, to the brink. Faced with this impossible situation, many are being forced to make a heart-wrenching decision: stay in the workforce and struggle with costs, or leave their jobs to care for their children. It’s a lose-lose scenario. Child care expenses are more than just a drain on the family budget; they’re a massive roadblock to economic stability and workforce participation.

Legal and Tax Implications of Paying Family for Childcare

Amid our family’s emotional and financial journey, a crucial aspect arises: the legal and tax nuances of compensating a family member for childcare. When a loved one, like the mother-in-law in our story, shifts from a volunteer to a paid caregiver, it comes with a bundle of legal responsibilities.

Parents become employers, navigating labor laws like minimum wage and working hours. They must wade into payroll taxes, handling W-2 forms and withholdings. Simultaneously, the mother-in-law’s babysitting income becomes taxable, potentially impacting her tax bracket and Social Security benefits.

These legal and tax intricacies add layers to the already complex realm of high childcare costs. Families must tread carefully, seeking advice and staying informed to meet all obligations.

But here’s an alternative path they might explore: an informal family agreement. Instead of delving into the legal and tax complexities, they could engage in open communication, defining a fair compensation arrangement. This approach prioritizes family harmony, flexibility, and trust while being mindful of potential tax implications.

Our local family’s tale is a reminder that these arrangements entail not just emotional and financial considerations but also intricate legal and tax responsibilities. It emphasizes the need for awareness and, possibly, professional guidance as family and finances intersect in today’s America.

As we ponder this complex web of family and finances, we’re compelled to question what truly matters. Are family bonds strengthened or strained by financial transactions within kin? It’s a thought-provoking dilemma that invites us to consider the delicate balance between the heart and the wallet in our ever-evolving family landscapes.

FAQ

Q1: My mother-in-law empties my monthly salary even though she and her husband earn. What should I do?

Q2: Why does my mother-in-law keep asking for money and my husband keeps giving it?

Q3: How do I deal with a mother-in-law who promised to take care of my newborn while I go to work but ended up not being around to do it?

Q4: My mother in law is always demanding attention from my husband. Also, she calls me and taunts me about my personality indirectly. Do I share these with my husband? Or just ignore her?